Zero Cost Collar Excel . Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the.

from savantwealth.com

Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses.

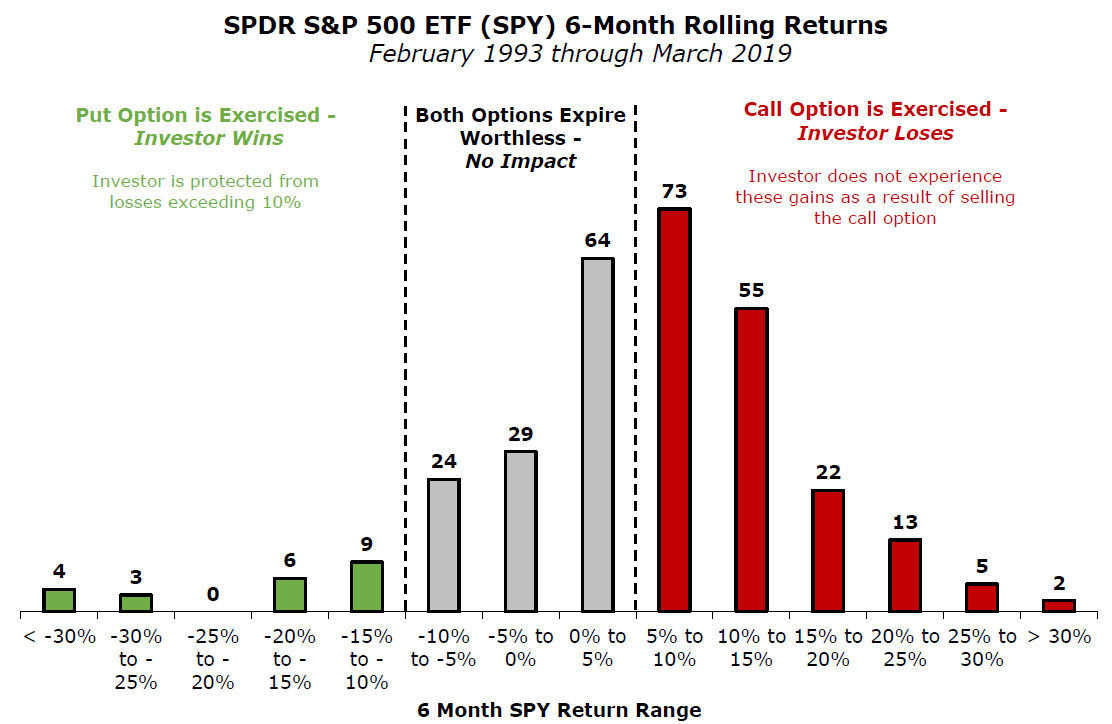

The ZeroCost Collar A Strategy to Limit Your Losses…and Gains

Zero Cost Collar Excel Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes.

From www.youtube.com

CFA Level 3 Derivatives Zero Cost Collar YouTube Zero Cost Collar Excel Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two. Zero Cost Collar Excel.

From www.deltavalue.de

Zero Cost Collar Optionsstrategie DeltaValue Zero Cost Collar Excel Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two. Zero Cost Collar Excel.

From www.slideserve.com

PPT Options and Corporate Financial Management PowerPoint Zero Cost Collar Excel Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding. Zero Cost Collar Excel.

From corporatefinanceinstitute.com

Collar Option Strategy Definition, Example, Explained Zero Cost Collar Excel Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding. Zero Cost Collar Excel.

From www.awesomefintech.com

Zero Cost Collar AwesomeFinTech Blog Zero Cost Collar Excel Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding. Zero Cost Collar Excel.

From slashtraders.com

Unlock ZeroCost Collar to Hedge Your Stocks for Free SlashTraders Zero Cost Collar Excel Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding. Zero Cost Collar Excel.

From investbro.id

Apa itu Zero Cost Collar? InvestBro Zero Cost Collar Excel Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate. Zero Cost Collar Excel.

From www.ig.com

Zero Cost Collar Strategy A Complete Trading Guide IG International Zero Cost Collar Excel Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate. Zero Cost Collar Excel.

From www.deltavalue.de

Zero Cost Collar Optionsstrategie DeltaValue Zero Cost Collar Excel Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding. Zero Cost Collar Excel.

From economiaenegocios.com

Definição de Collar de Custo Zero Economia e Negocios Zero Cost Collar Excel Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate. Zero Cost Collar Excel.

From savantwealth.com

The ZeroCost Collar A Strategy to Limit Your Losses…and Gains Zero Cost Collar Excel Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding. Zero Cost Collar Excel.

From www.slideshare.net

Zero Cost Collar Stock Put Zero Cost Collar Excel Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two. Zero Cost Collar Excel.

From www.slideserve.com

PPT Options and Corporate Financial Management PowerPoint Zero Cost Collar Excel Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate. Zero Cost Collar Excel.

From www.slideserve.com

PPT Options and Corporate Financial Management PowerPoint Zero Cost Collar Excel Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two. Zero Cost Collar Excel.

From www.slideserve.com

PPT Caps, Floors and Collars PowerPoint Presentation, free download Zero Cost Collar Excel Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two. Zero Cost Collar Excel.

From www.wyattresearch.com

Options Trading Made Easy ZeroCost Collar Zero Cost Collar Excel Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate. Zero Cost Collar Excel.

From www.scribd.com

Zero Cost Collar v1 (Aug 30) PDF Zero Cost Collar Excel Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate the. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two. Zero Cost Collar Excel.

From wallstreeteasy.com

COLLAR SIN COSTO (ZERO COST COLLAR) Wall Street Easy Zero Cost Collar Excel Web a zero cost collar is a trading strategy used to lock in profits from an underlying stock while avoiding losses. Web collar is a bullish strategy, as you are still exposed to underlying price changes between the two strikes. Web this function would generally be used in association with the option profit and loss functions to, for instance, calculate. Zero Cost Collar Excel.